The Swiss commercial real estate market is undergoing a notable transformation, driven by key investment players and shifting market dynamics. In a recent move, Edmond de Rothschild Real Estate Investment Management Suisse (REIM Suisse) secured approximately 54 million CHF in financing for a new commercial property strategy by the end of July. This initiative is part of a broader push to invest 100 million CHF into a diversified portfolio of offices, commercial spaces, and logistics by the close of 2024. With a long-term target of reaching 500 million CHF, REIM Suisse aims to facilitate a listing on the SIX Swiss Exchange.

Market Dynamics: A Shift Towards Commercial Real Estate

Investor sentiment is evolving. In March, UBS warned of potential risks in commercial real estate, pointing to higher-than-expected interest rates and a structural decline in demand for office and retail spaces. Yet firms like SPSS and Edmond de Rothschild argue that the focus on residential real estate has become overly pronounced. Both see higher returns in commercial property investments, with SPSS in particular now benefiting from an anti-cyclical strategy that focused on this asset class. This shift underscores a growing recognition that the commercial sector, despite challenges, offers robust returns driven by new market needs and economic conditions.

The Case for Commercial Real Estate

1. Higher Returns: Commercial properties are now viewed as offering superior yields compared to residential investments, with an attractive risk profile. REIM Suisse projects annual cash flow returns of 4.5% and total returns of 6%, making Swiss commercial real estate appealing to both local and international investors. In comparison, prominent residential-focused funds fall well below the 4% cash flow mark—though I won't name names, as I'm still on the job hunt. For the first half of 2023/2024, SPSS achieved cash flow returns of 2.75% on their Commercial Investment Fund.

2. Foreign Investment Opportunities: Unlike residential properties, which come with restrictions for foreign investors, commercial real estate in Switzerland is fully accessible to international capital. This factor makes Switzerland a particularly attractive destination for global investors seeking stable yields and growth potential.

3. Stability and Growth: Switzerland's economic stability and high quality of life drive continued demand for commercial real estate. As the country's population approaches 10 million, many investors may gravitate toward residential properties. However, the potential underrepresentation of modern commercial spaces could lead to a surge in demand for offices and logistics hubs.

Back to the Office—But Not Everywhere

While Sulzer recently announced a mandatory return-to-office policy, a survey of 21 large companies indicates that hybrid working models are likely to remain prevalent in Switzerland, at least in the medium term. In this context, location remains a critical factor for office spaces. Prime locations continue to have low vacancy rates, while secondary markets, such as Glattbrugg, Wallisellen, Lausanne West, and Geneva Airport, report vacancy rates of up to 7.7% at the beginning of 2024, according to JLL. Moreover, the construction of new office space is set to decrease dramatically, from 265,000 m² annually between 2019 and 2023 to just 139,000 m² in 2025.

Logistics: High Demand, Limited Supply

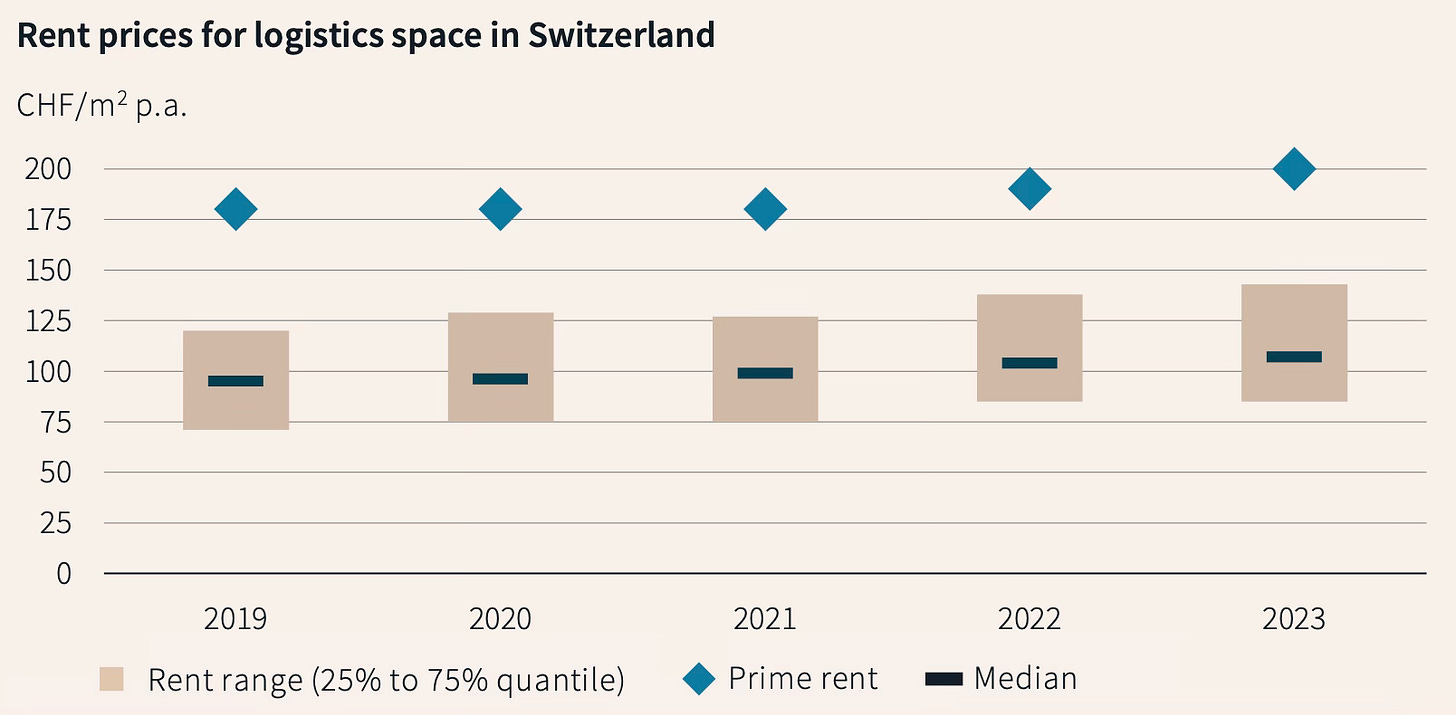

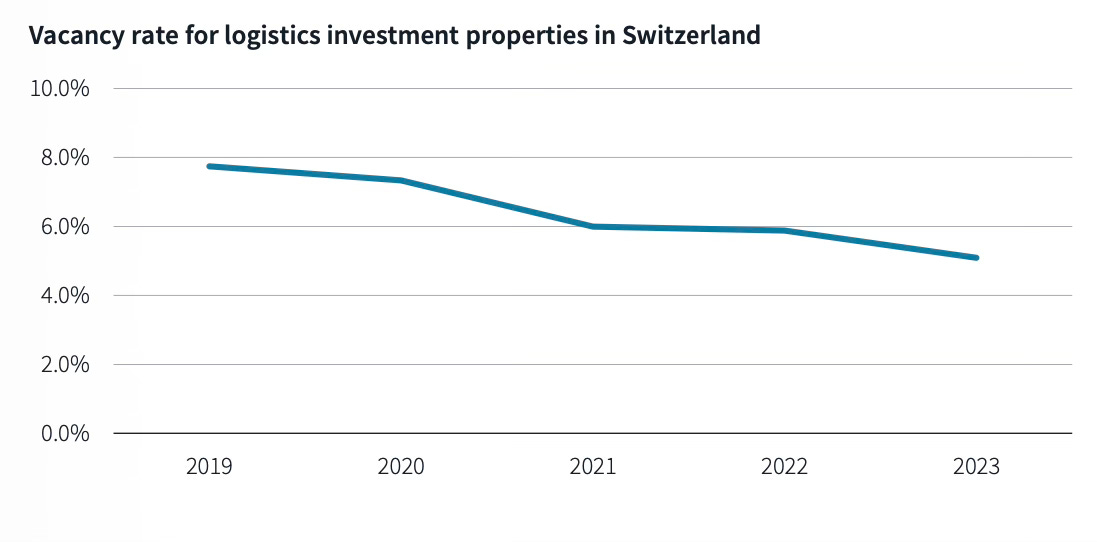

Logistics rents have soared in Switzerland over the past two years, exceeding 200 CHF/m² annually in prime locations, while vacancy rates have steadily decreased over the last four years.

Yet many logistical facilities are aging, creating demand for modern, automated high-bay warehouses and renewable energy solutions. Location also remains critical, particularly proximity to end customers. However, developing new logistics centers presents challenges, including regulatory hurdles, traffic concerns, and municipal resistance to heavy truck activity. Those who manage to navigate these barriers could capitalize on the scarcity of prime logistical sites.

While the commercial real estate market covers a wide array of sectors, from hotels to retail spaces, I'll save those topics for my next article.